Your Source for the Latest in Crypto Trends

DBS has introduced DBS Treasury Tokens, leveraging its EVM-compatible permissioned blockchain to boost the efficiency and speed of multi-currency treasury operations. This new blockchain-based solution, developed in partnership with Ant International, marks the beginning of a pilot launch in Singapore.

The DBS Treasury Tokens aim to streamline liquidity management across various currencies for Ant International’s entities. By integrating DBS’ permissioned blockchain with Ant International’s Whale platform, the solution facilitates seamless intragroup liquidity management. This integration enhances workflow and financial visibility within the organization.

Ant International’s Whale platform, which combines blockchain technology, advanced encryption, and AI, will benefit from this collaboration. Kelvin Li, Head of Platform Tech at Ant International, highlights that this partnership helps address cross-border payment challenges, such as reducing costs and transaction risks.

The DBS Treasury Tokens are particularly beneficial for large corporations like Ant International, operating across diverse markets and time zones. They are designed to cut down the settlement time for intra-group transactions from days to seconds, thereby improving liquidity and working capital management.

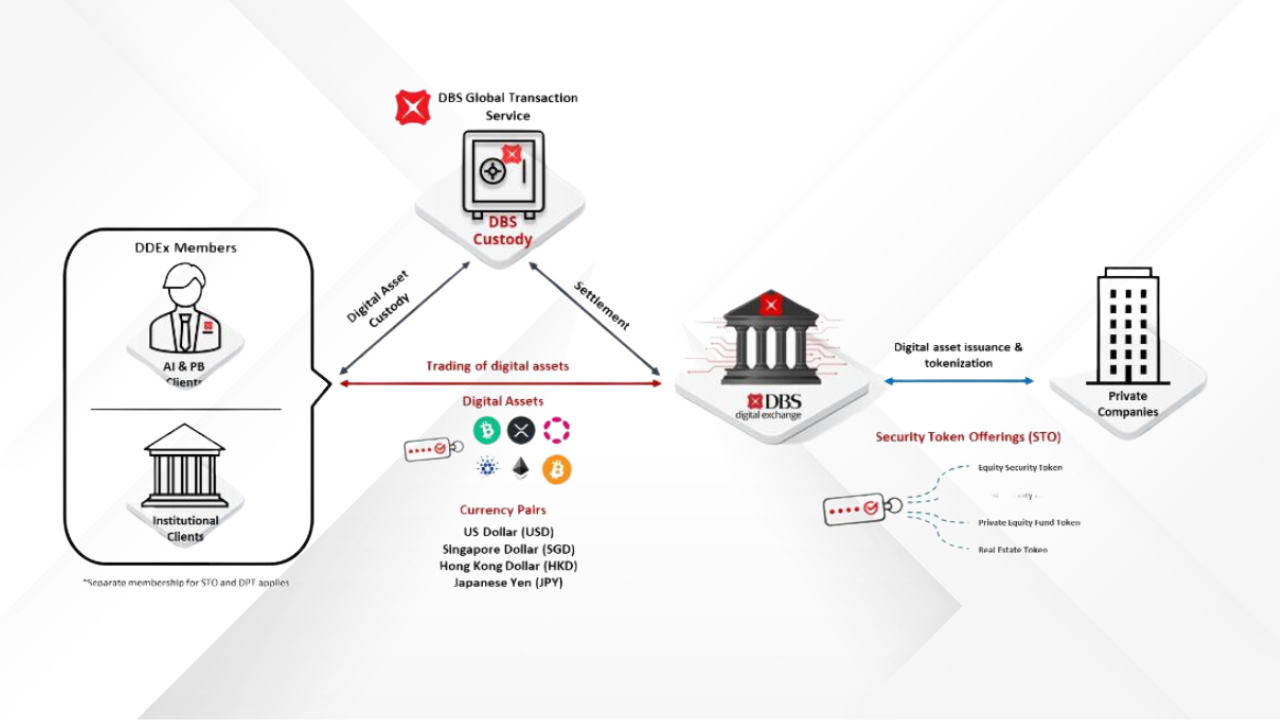

Lim Soon Chong, Group Head of Global Transaction Services at DBS Bank, comments that the launch of DBS Treasury Tokens reflects evolving business needs, especially with the rise of e-commerce and on-demand services. This solution is part of DBS’ broader strategy to harness blockchain technology for enhancing traditional banking services, including programmable and fractionalized value transfers.

The DBS permissioned blockchain, compatible with the Ethereum virtual machine (EVM), integrates with the bank’s core payments engine. This integration aims to improve the system’s compatibility with various industry payment infrastructures.

The development of DBS Treasury Tokens is also influenced by the bank’s involvement in the Monetary Authority of Singapore’s (MAS) Project Orchid and Project Guardian. These initiatives explore tokenization in financial services. Ant International is participating in Project Guardian as well, where it has developed a treasury management solution for real-time multi-currency clearing and settlement, covering over 40 currencies.

Project Guardian, launched in 2022, is a collaborative effort led by MAS to explore the potential of asset tokenization and DeFi in enhancing financial market efficiency and liquidity. This initiative brings together policymakers, financial institutions, and industry players to test and develop digital asset use cases within a regulated framework.