Your Source for the Latest in Crypto Trends

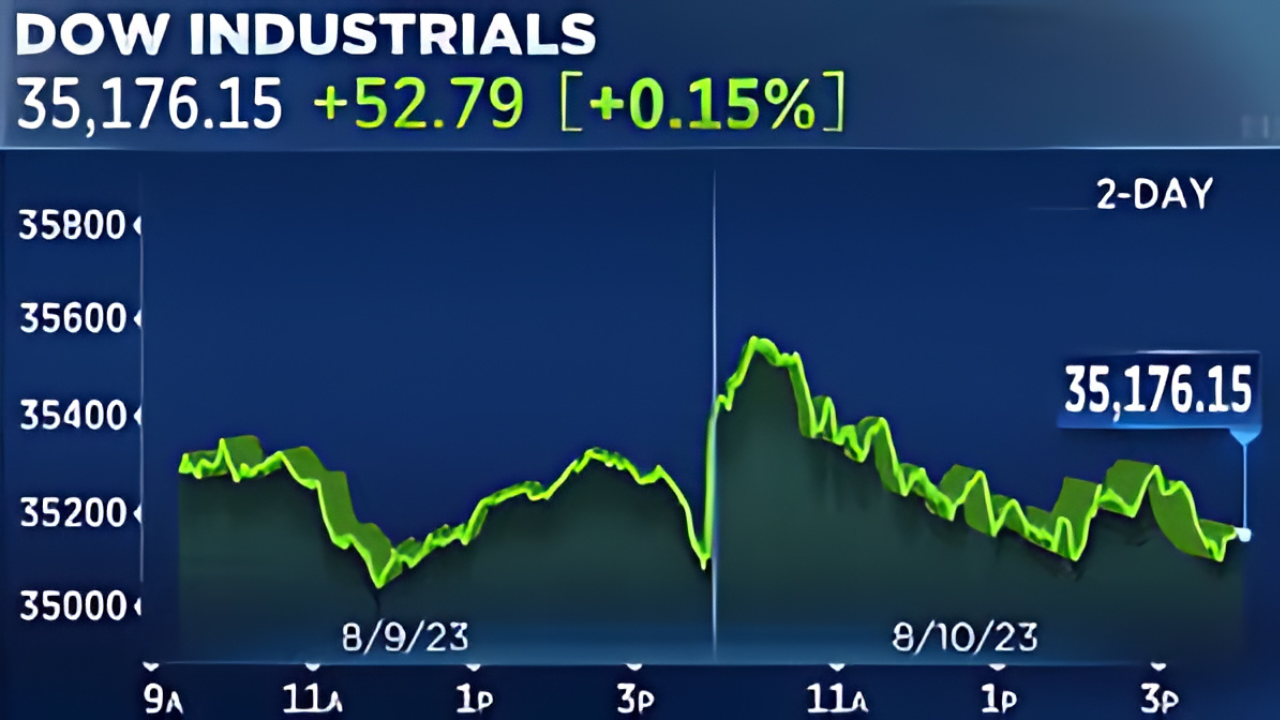

On Thursday, U.S. stocks saw gains, with the Dow Jones Industrial Average leading the way. This came after investors had time to process Nvidia’s (NVDA) strong yet somewhat underwhelming earnings report, alongside new data showing that the U.S. economy grew at a faster pace than anticipated in the last quarter.

The Dow Jones Industrial Average (^DJI) climbed 0.7%, bringing it closer to reaching new record highs. Meanwhile, the tech-centric Nasdaq Composite (^IXIC) rose by 0.5%, and the S&P 500 (^GSPC) saw a modest gain of around 0.3%, following recent losses across all three indices.

Investor sentiment remained positive despite a lukewarm reaction from Wall Street to Nvidia’s results. While the AI chipmaker reported quarterly profits and revenue that exceeded expectations, the margins of these beats fell short of the lofty expectations set by the market. This led to concerns that the AI boom may be cooling off, causing Nvidia’s stock to initially drop by 6%. However, the shares managed to recover some of those losses by market open.

Additionally, there appears to be a shift away from tech stocks, as evidenced by the stronger performance of the Dow and the Russell 2000 (^RUT) prior to the market opening.

In other earnings news, Salesforce (CRM) shares surged after the software company reported a significant earnings beat. On the other hand, Dollar General (DG) shares plummeted by 25% after the retail chain lowered its full-year outlook, citing weaker sales in the second quarter due to “financially constrained” customers.

The U.S. economy grew more robustly than expected in the second quarter, with the latest gross domestic product (GDP) data showing a 3% annualized increase for the three-month period, up from an earlier estimate of 2.8%.

Additionally, weekly U.S. jobless claims fell to 231,000, down from the previous week’s numbers and slightly below the 232,000 forecast by economists.

Market participants are closely monitoring economic indicators to gauge how quickly and significantly the Federal Reserve might lower interest rates, especially after Fed Chair Jerome Powell hinted at a potential rate cut coming in September.