Your Source for the Latest in Crypto Trends

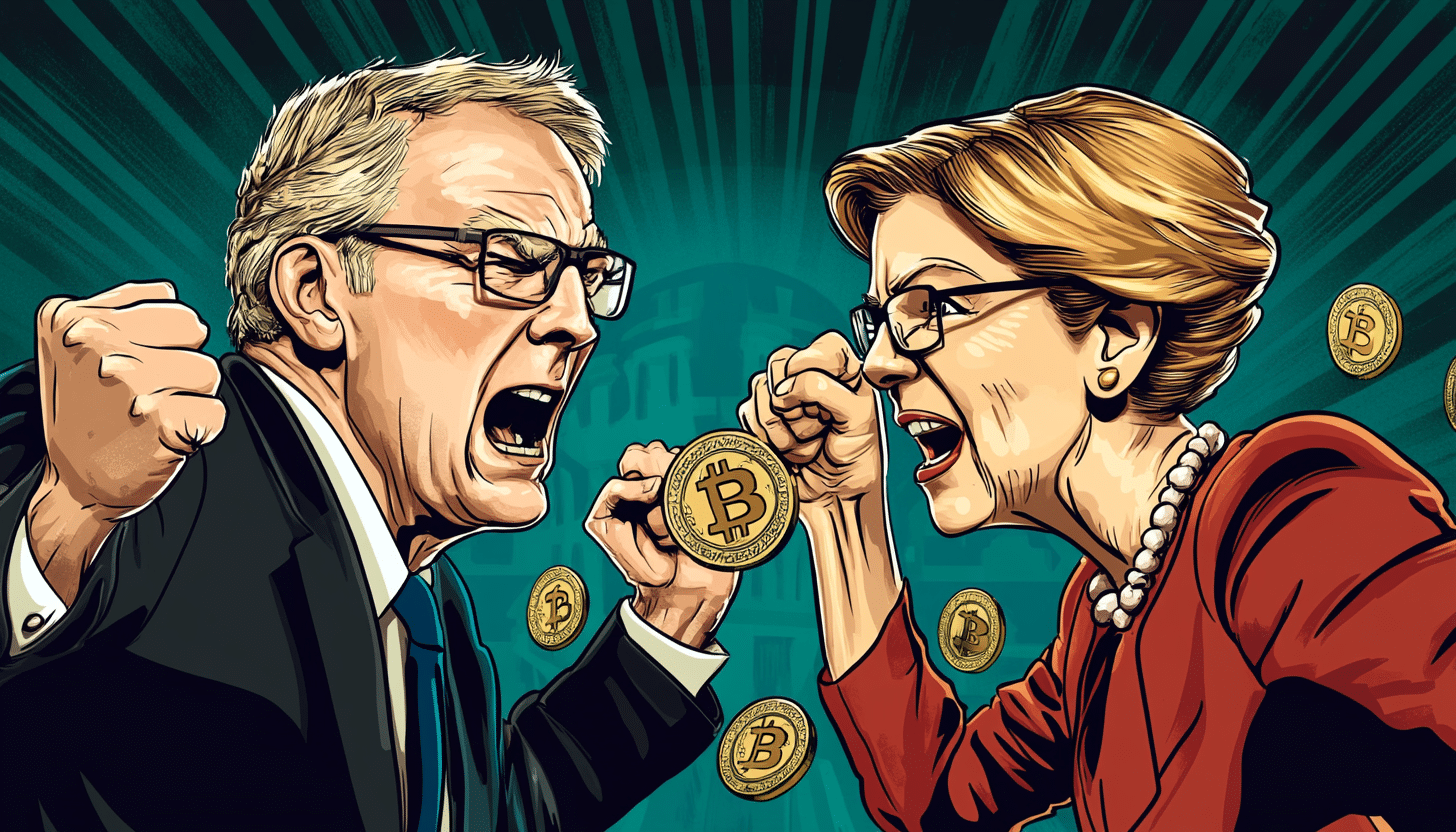

Cryptocurrency’s influence on politics is growing, and a recent debate between U.S. Senator Elizabeth Warren and attorney John Deaton highlights this trend. As the discussion on crypto regulation heats up, their arguments show how digital currencies could play a role in shaping the future of U.S. legislation. Here’s a closer look at the key points from their debate and what it could mean for crypto enthusiasts and investors.

The debate emerged amidst increasing government interest in regulating cryptocurrencies. Senator Warren has been vocal about her concerns over the potential risks posed by crypto, such as fraud, money laundering, and financial instability. On the other hand, John Deaton, a well-known advocate for crypto rights and the founder of Crypto Law, argues that the government is overreaching and harming innovation in the sector.

Senator Warren believes that strong regulations are necessary to protect consumers and ensure the stability of the financial system. She has often referred to crypto as the “Wild West” of finance, suggesting that a lack of oversight allows for fraud and illegal activities. Her calls for strict rules aim to bring the crypto market in line with other financial sectors, enforcing standards to safeguard investors.

John Deaton counters that aggressive regulation could stifle innovation and drive crypto businesses out of the U.S. He argues that crypto offers significant opportunities for technological advancement and financial freedom. According to Deaton, the approach to regulation should encourage growth and only target undesirable actors rather than treating all crypto activities with suspicion.

The debate between Warren and Deaton is a sign that crypto is no longer just a niche topic; it’s becoming a key issue in U.S. politics. With more people investing in digital assets, lawmakers are feeling the pressure to establish a clear regulatory framework. Influential senators’ stance in the ongoing discussion could significantly influence the future of cryptocurrency in America.

As the government continues to explore ways to regulate crypto, it’s clear that finding a balance between protecting consumers and encouraging innovation will be challenging. Investors and crypto companies will need to stay informed and prepared for potential changes in the regulatory landscape.

The heated debate between Warren and Deaton showcases the ongoing struggle to define the role of cryptocurrency in U.S. legislation. The outcome could shape the future of crypto and its place in the financial system. Whether strict regulations or a more flexible approach win, the influence of crypto on the Senate is undeniable.